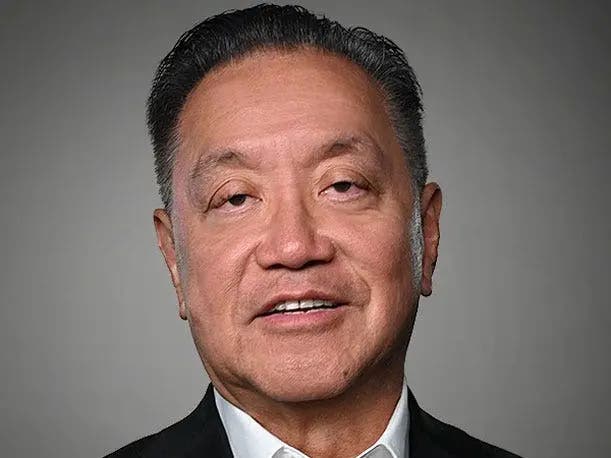

Broadcom CEO Hock Tan: Focus On Upselling VMware’s ‘Largest 2,000’ Customers Proves ‘Very Successful’

by nlqip

Tan says Broadcom expects double-digit revenue gains from its VMware Cloud Foundation as it is focused on providing resources, support and upselling for VMware’s ‘largest 2,000 strategic customers.’

Broadcom CEO Hock Tan expects his company’s VMware business to grow double-digits for the rest of the year as Broadcom’s sales teams work on upselling the 2,000 strategic customers he inherited on the parts of the VMware stack they don’t use.

“We are very focused on upselling and helping customers not just buy, but deploy this private cloud, what we call virtual private cloud solution or platform, in their on-prem data centers. It has been very successful so far,” Tan said Thursday during a conference call with financial analysts. “I agree, it is early innings. We just closed on the deal in late November and now it’s early March. But we have been very prepared to launch and focus on this push, initiative, VCF [VMware Cloud Foundation]. The results have been very much what we expect them to be which is very, very successful.”

[RELATED STORY: Broadcom’s ‘Driving Force’ CEO Hock Tan Gets A $161.8M Fill-Up]

Tan said revenue from VMware will grow by double digits, sequentially, quarter over quarter, through the rest of the fiscal year. He said VCF — an on-prem, self-service cloud platform — can either act as a complement or an alternative to public cloud.

“This is simply a result of our strategy with VMware. We are focused on upselling customers. Particularly those who are already running their compute workloads with vSphere virtualization tools to upgrade to VMware Cloud Foundation, otherwise branded as VCF,” Tan said. “VCF is the complete software stack integrating compute, storage, networking that virtualizes and modernizes our customers data centers.”

Tan reminded analysts that VMware also has a partnership with chipmaker Nvidia, which enables VMware Cloud Foundation to run GPUs.

“This allows customers to deploy their AI models on prem and wherever they do business without having to compromise on privacy and control of their data,” Tan said. “We’re seeing this capability drive strong demand for (VMware Cloud Foundations) from enterprises looking to run their growing workloads on prem.”

For the quarter Broadcom’s revenue came in at $11.96 billion up 34 percent year over year, with about $2.1 billion after 10 and a half weeks, but Tan said demand is strong. Broadcom’s net income came in at $1.32 billion for earnings per share of $2.84 for the first quarter. Broadcom also announced a quarterly dividend of $5.25 per share.

Tan called VMware the “star of the show” with regards to Broadcom’s software sales as he outlined how the company has used the last three months to plot how to get the most out of the $69 billion acquisition.

Three months in, everything is going as planned, Tan said.

“Things seem to be progressing very well as we had hoped it would. Because where we are focusing our resources — on not just go-to-market, but in engineering a very improved VCF stack, which we have. And selling it out there. And then being able to support it. And then in the process, help customers deploy. And help customers start to really stand it up in their data center — all that focus is on the largest 2,000 strategic customers,” Tan said. “These are guys who want to still have significant distributed data centers on prem.”

Broadcom reiterated its software revenue guidance of $20 billion for the full fiscal year. For fiscal 2024 Broadcom now expects networking revenue to grow at over 35 percent year on year compared to 30 percent. Wireless chip revenue decreased however Tan said he expects revenue in that segment to be flat year on year.

Overall Tan said fiscal 2024 revenues are expected to arrive at $50 billion, which represents 40 percent growth year over year. Tan said stronger than expected AI sales propped up cyclical weakness in other parts of the business.

“I know we told you in December our revenue from AI would be 20 percent of our full year, semi conductor revenue. We now expect revenue from AI to be much stronger, representing some 35-percent of semi-conductor revenue at over $10 billion,” he said.

Broadcom noted the sale of VMware’s end user compute business, which is expected to be finalized by the end of this fiscal year with a reported price tag of $4 billion. Broadcom said it would not sell Carbon Black after all and will merge that with the parts left over from its Symantec acquisition to form the “Enterprise Security Group.”

“The impact on revenue and profitability is not significant,” Broadcom CFO Kristen Spears said.

Source link

lol

Tan says Broadcom expects double-digit revenue gains from its VMware Cloud Foundation as it is focused on providing resources, support and upselling for VMware’s ‘largest 2,000 strategic customers.’ Broadcom CEO Hock Tan expects his company’s VMware business to grow double-digits for the rest of the year as Broadcom’s sales teams work on upselling the 2,000…

Recent Posts

- Everything That You Need to Know About the Dark Web and Cybercrime | BlackFog

- Security plugin flaw in millions of WordPress sites gives admin access

- Phishing emails increasingly use SVG attachments to evade detection

- Fake AI video generators infect Windows, macOS with infostealers

- T-Mobile confirms it was hacked in recent wave of telecom breaches