AMD: Instinct AI Chip Sales Exceed Expectations As Microsoft Expands Consumption

by nlqip

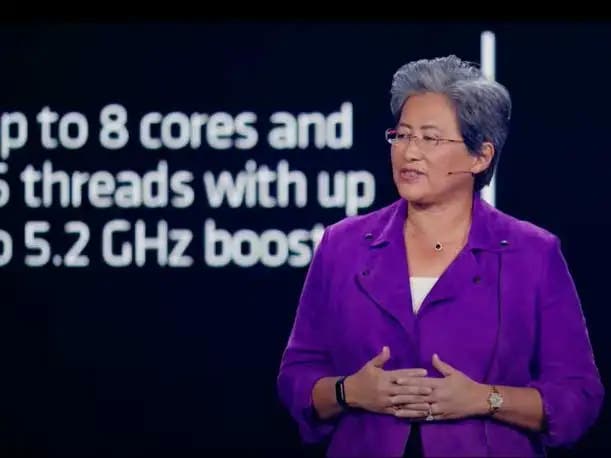

AMD CEO Lisa Su says a ‘steep ramp’ of Instinct MI300 GPUs allowed the product family to exceed $1 billion in quarterly revenue for the first time. This meant the MI300 chips made up more than a third of AMD’s reported $2.8 billion in second-quarter data center revenue.

AMD said sales exceeded expectations in the second quarter for its Instinct data center GPUs, EPYC data center CPUs and Ryzen client CPUs, which helped it boost gross profit by 17 percent and double data center revenue from a year ago.

On its earnings call Tuesday, AMD CEO Lisa Su said a “steep ramp” of the chip designer’s Instinct MI300 GPUs allowed the product family to exceed $1 billion in quarterly revenue for the first time. This meant the MI300 chips made up more than a third of AMD’s reported $2.8 billion in data center revenue for the second quarter.

[Related: Forrest Norrod On How AMD Is Fighting Nvidia With ‘Significant’ AI Investments]

Data center revenue was up more than 115 percent year-over-year, primarily due to the fast ramp of Instinct chips along with strong sales growth of its fourth-generation EPYC CPUs.

Meanwhile, client computing segment was up 49 percent-year-over-year to $1.5 billion while the gaming segment was down 59 percent to $648 million from a year ago and the embedded segment was also down 31 percent across the same period.

This added up to a total revenue of $5.8 billion for the second quarter, which was 9 percent higher than it was a year ago and up 7 percent from the previous three-month period.

The stronger-than-expected demand for Instinct chips prompted the Santa Clara, Calif.-based company to upgrade its forecast for full-year data center GPU revenue to $4.5 billion, which is $500 million higher than the guidance it issued in April.

For the third quarter, AMD expects total revenue to reach roughly $6.7 billion, plus or minus $300 million, which would represent a roughly 16 percent increase year-over-year and a 5 percent sequential increase, according to the company.

AMD’s stock price was up more than 7.5 percent in after-hours trading.

The chip designer reported its momentum as it seeks to whittle away at Nvidia’s dominance of the AI computing space, where its rival’s data center GPUs like the H100 have been in high demand due to a flurry of generative AI development.

“This has been an incredible ramp, and I’m actually really proud of what the team has done in terms of definitely the fastest ramp that we’ve ever done,” Su said on call.

One key customer that has contributed to AMD’s fast ramp of Instinct GPUs is Microsoft, which is using the GPU-only MI300X to power OpenAI’s GPT-4 Turbo model and multiple Copilot services, including Microsoft 365 chat, Word and Teams, according to Su.

The Windows giant also became the first large hyperscaler to launch public MI300X-based instances through Azure in the second quarter.

Among the first customers to use the new MI300X-based Azure instances was model repository Hugging Face, which is enabling one-click deployment for AI models.

Su said Dell Technologies, Hewlett Packard Enterprise, Lenovo and Supermicro all have Instinct server platforms in production. In addition, multiple hyperscalers and tier-two cloud providers “are on track to launch MI300 instances” in the third quarter, she added.

The company has also made progress in enabling customers to implement the latest AI models on its Instinct platforms, according to Su. This activity includes the MI300’s industry-first support of Stability AI’s new Stable Diffusion 3.0 image-generation model and its support for Meta’s recently launched Llama 3.1 models.

Su said AMD remains on track to launch its next-generation Instinct GPU, the MI325X, later this year, which will be followed by the MI350 series in 2025 and the MI400 series in 2026.

“Looking across our AI business, customer response to our multi-year Instinct and ROCm roadmaps is overwhelmingly positive, and we are very pleased with the momentum we are building,” she said.

Cloud, Enterprise Adoption Fuel Double-Digit EPYC Growth

In the second quarter, AMD saw a “strong double-digit percentage increase” in EPYC CPU sales, thanks to growing adoption by cloud service providers and enterprise customers, according to Su.

Among all cloud service providers, there are now more than 900 EPYC-powered instances available, 34 percent higher than there were a year ago, the CEO said. The largest cloud providers are also using EPYC to “power more of their internal workloads,” she added.

Su indicated that this is allowing AMD to take share away from x86 rival Intel.

“We are seeing hyperscalers select EPYC processors to power a larger portion of their applications and workloads, displacing incumbent offerings across their infrastructure with AMD solutions that offer clear performance and efficiency advantages,” she said.

Among the businesses fueling demand for EPYC-based cloud instances are Netflix and Uber, which are using CPU line’s fourth generation “as one of the key solutions to power their mission-critical, customer-facing workloads,” according to Su.

As for enterprise customers buying EPYC-based servers, the chief executive said sell-through activity in that area increased by a “strong double-digit percentage sequentially.”

“We closed multiple large wins in the quarter with financial services, technology, healthcare, retail manufacturing and transportation customers, including Adobe, Boeing, Industrial Light and Magic, Optiver and Siemens,” Su said.

In a sign of growing enterprise acceptance of the EPYC brand, the CEO said, “more than one third of AMD’s enterprise server wins in the first half of the year were with businesses deploying EPYC in their data centers for the first time.”

The next generation of EPYC processors, code-named Turin, started to ship to lead cloud customers in the second quarter, and the company expects “broad OEM and cloud availability” later this year, according to Su.

‘Strong Demand’ For Ryzen CPUs Drive PC Growth

Su said the main drivers for growth in the client computing segment was “strong demand” for AMD’s previous-generation Ryzen processors along initial shipments of its next-generation Zen 5 processors, which include the Ryzen AI 300 series for AI PCs.

The CEO said more than 100 PC designs using the Ryzen AI 300 series across the premium, gaming and commercial segments “are on track to launch from Acer, Asus, HP Inc., Lenovo and others over the coming quarters.”

“Customer excitement for our new Ryzen processors is very strong, and we are well positioned for ongoing revenue share gains based on the strength of our leadership portfolio and design win momentum,” Su said.

Gaming, Embedded Segments Take A Big Hit

While AMD reported strong traction for its data center and client computing businesses, the company saw the opposite in its gaming and embedded segments.

Gaming revenue fell mainly because of lower semi-custom system-on-chip sales that was the result of softening demand for video game consoles like Sony’s PlayStation 5 that are entering their fifth year in the console cycle, according to Su.

Revenue from PC graphics chips, on the other hand, grew year-over-year due to “improved sales” of the company’s Radeon 6000 and 7000 series GPUs, she added.

The embedded segment, which includes business from AMD’s acquisition of programmable chip designer Xilinx, took a similar hit.

Su said while “the first quarter marked the bottom” for the business and revenue in the second quarter was roughly the same, the company did see “early signs of order patterns improving,” leading it to expect a gradual recovery in the second half of the year.

“Longer term, we are building strong design win momentum for our expanded embedded portfolio,” she said. “Design wins in the first half of the year increased by more than 45 percent from the prior year to greater than $7 billion, including multiple triple-digit million-dollar wins combining our adaptive and x86 compute products.”

Source link

lol

AMD CEO Lisa Su says a ‘steep ramp’ of Instinct MI300 GPUs allowed the product family to exceed $1 billion in quarterly revenue for the first time. This meant the MI300 chips made up more than a third of AMD’s reported $2.8 billion in second-quarter data center revenue. AMD said sales exceeded expectations in the…

Recent Posts

- Arm To Seek Retrial In Qualcomm Case After Mixed Verdict

- Jury Sides With Qualcomm Over Arm In Case Related To Snapdragon X PC Chips

- Equinix Makes Dell AI Factory With Nvidia Available Through Partners

- AMD’s EPYC CPU Boss Seeks To Push Into SMB, Midmarket With Partners

- Fortinet Releases Security Updates for FortiManager | CISA