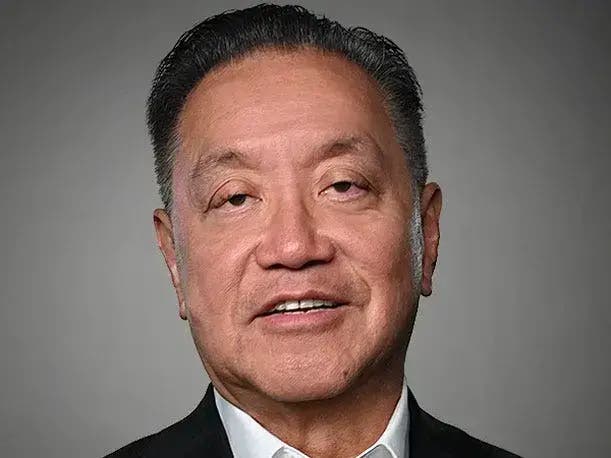

Broadcom CEO Hock Tan: VMware Bookings ‘Continued To Accelerate,’ While AI Chip Sales Surge

by nlqip

‘The transformation of the business model of VMware continues to progress very well .. The success of this strategy was reflected in the performance in Q3. We booked more than 15 million CPU cores of VCF,’ Broadcom CEO Hock Tan told investors.

Broadcom’s third quarter saw overall revenue leap 47 percent to $13.07 billion during its most recent quarter, as AI infrastructure sales surged and VMware bookings “continue to accelerate,” CEO and President Hock Tan said.

“The VMware business continues to book very well as we convert our customers in two ways,” Tan said during the company’s third quarter earnings call Thursday. “One from perpetual to subscription license, but also those subscription licenses are for the full stack of VCF and that has been very successful given the high ratio of VCF subscribers, new subscribers, that we have achieved. We see this trend continuing in Q4, very much so and very likely into ‘25.”

Tan told investors that VMware revenue contributed $3.8 billion as Broadcom has rapidly changed how VMware is sold since completing a $69 billion acquisition to buy the virtualization market leader in November 2023.

“The transformation of the business model of VMware continues to progress very well .. The success of this strategy was reflected in the performance in Q3,” Tan said. “We booked more than 15 million CPU cores of VCF.”

Tan said that translates into annual booking value of $2.5 billion, which represents 32 percent growth quarter to quarter.

[RELATED: Broadcom’s Five Biggest Announcements At VMware Explore]

“Directionally, we continue to see accelerated bookings and accelerated growth,” Tan said.

He said spending at VMware has also continued to fall under Broadcom. Operating costs last quarter were $1.3 billion, down from $1.6 billion in the previous quarter. He aims to cut more. Broadcom reported a net loss of $1.8 billion for its latest quarter, compared with net income of $3.3 billion in the same quarter a year ago.

“Q4 will continue the trajectory of revenue continuing to grow and expenses still dropping, even as it starts to stabilize, but continue to reduce,” Tan said on the call.

Tan said sales of Broadcom’s semiconductor accelerators and networking to hyperscalers grew at 5 percent year on year. He said there has been a turn towards spending on infrastructure products including AI.

As a result Broadcom raised its guidance on AI chips for the year from $11 billion to $12 billion, driven by strong demand from hyperscalers for custom AI accelerators which Tan said grew 3.5x year on year.

“We expect revenue from AI to be $12 billion for fiscal year 2024 driven by ethernet networking and custom accelerators for AI data centers,” Hock Tan, President and CEO of Broadcom Inc., said

“We don’t guide yet for fiscal ‘25, but we do expect fiscal ‘25 to be strong. Strong growth on our AI revenue,” Tan said.

Tan said following an extended down cycle in enterprise spending, Broadcom said it sees more spending ahead.

“We’ve gone through the downcycle,” Tan said. “It’s on an uptick … And given the rate of bookings it will go, I dare say, as AI goes to the enterprise. You need to upgrade servers. You need to upgrade storage. You need to upgrade networking across your entire ecosystem. We could be headed for an upcycle that could meet or even surpass previous upcycles. Simply because the amount of bandwidth you ned to store and manage all the workloads coming out of AI.”

Broadcom shares sank more than 6 percent in after-hours trading Thursday to $142.51.

Source link

lol

‘The transformation of the business model of VMware continues to progress very well .. The success of this strategy was reflected in the performance in Q3. We booked more than 15 million CPU cores of VCF,’ Broadcom CEO Hock Tan told investors. Broadcom’s third quarter saw overall revenue leap 47 percent to $13.07 billion during…

Recent Posts

- Arm To Seek Retrial In Qualcomm Case After Mixed Verdict

- Jury Sides With Qualcomm Over Arm In Case Related To Snapdragon X PC Chips

- Equinix Makes Dell AI Factory With Nvidia Available Through Partners

- AMD’s EPYC CPU Boss Seeks To Push Into SMB, Midmarket With Partners

- Fortinet Releases Security Updates for FortiManager | CISA