Nvidia And AI ‘Supercharged’ Microsoft, Amazon And Google Cloud Infrastructure Growth

by nlqip

‘Over the last 10 years ODMs have continued to eat up server market share, and now we see Nvidia’s explosive growth, which is largely fueled by sales to hyperscalers—either directly or indirectly,’ said John Dinsdale, Synergy Research Group’s chief analyst.

Cloud revenues reached $427 billion in the first half of 2024, up 23 percent year over year, as Google, Amazon and Microsoft continue to expand their cloud infrastructure footprint to boost its artificial intelligence reach and cloud sales.

“Cloud markets were already growing strongly and AI has now supercharged some of that growth,” said John Dinsdale, a chief analyst at Synergy Research Group, in an email to CRN. “We see this particularly in the rollout of new and expanded hyperscale data centers.”

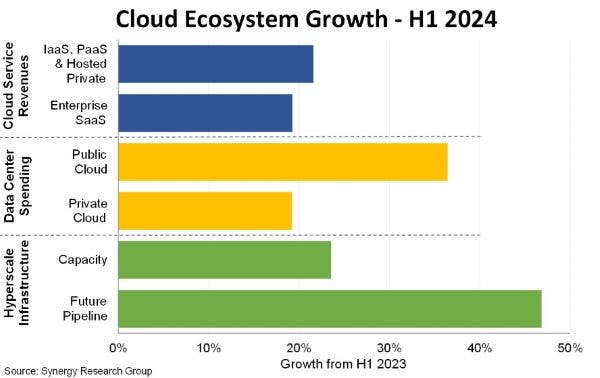

Public cloud companies’ global spending on data center infrastructure grew a whopping 36 percent year over year, led by the big three: Google, Microsoft and Amazon, according to new data by Synergy Research Group.

More technology is “being sold directly to cloud providers and enterprises,” bypassing more traditional system vendors, he said.

[Related: Google Cloud CEO: Why Customers Are Betting Their GenAI Future On Google’s AI Technology]

Specifically, Nvidia is directly selling AI hardware, such as Nvidia’s popular processors, to cloud hyperscalers as they build new cloud data centers.

“Over the last 10 years ODMs [original design manufactures] have continued to eat up server market share, and now we see Nvidia’s explosive growth, which is largely fueled by sales to hyperscalers—either directly or indirectly,” said Synergy’s Dinsdale.

“In the first half of 2024, revenues from Nvidia’s data center business unit far surpassed the combined revenues of Dell and HPE in data centers,” he added.

Nvidia ‘Rapidly Growing Its Influence’

Across software-as-a-service (SaaS) and cloud infrastructure services, the global market leaders are Microsoft, Amazon, Google and Salesforce.

In worldwide data center hardware and software, ODMs continue to account for a large block of the market as hyperscale operators use their own-designed servers, supplied by contract manufacturers.

Beyond ODMs, the market leaders are Dell Technologies, Microsoft, Super Micro and Hewlett Packard Enterprise.

“Here, Nvidia is rapidly growing its influence as it sells to server vendors, other technology companies, enterprises, and directly to hyperscale operators,” said Dinsdale.

Microsoft, Google and Amazon are each spending billions of dollars annually on building cloud data centers in new regions across the globe.

It seems hyperscalers can’t build cloud infrastructure fast enough. For example, the Three Mile Island nuclear power plant is reopening in Pennsylvania in order to exclusively sell power to Microsoft to enable its AI ambitions.

Hyperscale Data Center Capacity ‘Continues To Balloon’

The market for building and equipping cloud-related data centers has received a huge boost from products required to support AI functionality, and growth rates there have for once surpassed cloud service growth rates.

In the first half of 2024, cloud services sales growth averaged 21 percent compared to first half 2023. Comparatively, spending on public and private cloud data centers grew by an average of 30 percent.

“Demand for hyperscale data center capacity continues to balloon,” said Dinsdale.

The operational capacity of these huge hyperscaler data center networks grew by 24 percent in the first half of 2024 year over year.

Additionally, the size of their pipeline for future data centers grew by 47 percent as they continue to ramp up investments for the long-term, according to Synergy data.

America ‘Remains A Center Of Gravity’

Synergy’s market data includes first half market stats for cloud infrastructure services, SaaS, data center hardware and software, data center leasing and hyperscale infrastructure.

Geographically, while cloud markets are growing strongly in all regions of the world, the United States remains a center of gravity, according to Synergy research.

In the first half of 2024, America accounted for 44 percent of all cloud service revenues, 53 percent of hyperscale data center capacity, and 47 percent of the market for cloud data center hardware and software.

Across all service and infrastructure markets, the vast majority of leading players are U.S.-based companies. Chinese-based companies accounted for 8 percent of all cloud service revenues and 16 percent of hyperscale data center capacity.

Source link

lol

‘Over the last 10 years ODMs have continued to eat up server market share, and now we see Nvidia’s explosive growth, which is largely fueled by sales to hyperscalers—either directly or indirectly,’ said John Dinsdale, Synergy Research Group’s chief analyst. Cloud revenues reached $427 billion in the first half of 2024, up 23 percent year…

Recent Posts

- Xerox To Buy Lexmark For $1.5B In Blockbuster Print Deal

- Vulnerability Summary for the Week of December 16, 2024 | CISA

- Arm To Seek Retrial In Qualcomm Case After Mixed Verdict

- Jury Sides With Qualcomm Over Arm In Case Related To Snapdragon X PC Chips

- Equinix Makes Dell AI Factory With Nvidia Available Through Partners