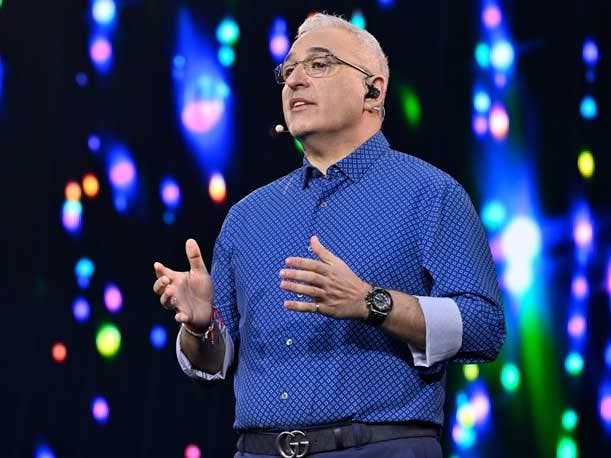

CEO Antonio Neri On HPE’s Supercomputing Advantage Over AWS, ‘Huge’ VM Essentials Opportunity And “Super Strong’ Results

by nlqip

Hewlett Packard Enterprise CEO Antonio Neri says he does not see traditional supercomputing workloads moving to AWS’ just-announced UltraCluster AI supercomputer.

Hewlett Packard Enterprise CEO Antonio Neri said he does not see traditional supercomputing workloads moving to Amazon Web Services’ just-announced UltraCluster AI supercomputer.

“I don’t see anytime soon the traditional supercomputing workloads moving there because the cost is prohibitive,” Neri told CRN when asked about the new AWS UltraCluster supercomputer. “Now we know hyperscalers, including AWS, tend to focus on disaggregating the architecture so they have more control of their stack. But that’s true for maybe generative AI, but I’m not sure it’s true for the traditional supercomputer workloads.”

AWS announced this week that it is building the UltraCluster AI supercomputer — named Project Rainier — which will be released next year – with AWS’ own Trainium2 chips. Those Trainium2 chips go head-to-head against Nvidia’s popular GPUs, which are part of the ‘Nvidia AI Computing By HPE’ portfolio including HPE Private Cloud AI.

AWS has said its UltraCluster supercomputer will contain hundreds of thousands of Trainium2 chips with more than 5x the number of exaflops used to train their current generation of leading AI models.

AWS declined to comment.

Neri said it remains to be seen what “use cases” the AWS supercomputer will address for customers. “If you think about exabytes of data it is hard to say what customers, particularly the most sensitive customers that do a lot of simulation, modeling or very large training models, will do with it,” he said. “We will see what use cases they can address.”

Neri said HPE’s unique supercomputing “expertise” packs a big punch given that it holds seven of the top 10 supercomputing systems on the Green500 list including the top three supercomputers. The Green500 list ranks the world’s most energy-efficient supercomputers.

HPE, Neri said, also has the industry’s first 100 percent fanless direct liquid cooled systems architecture, which is aimed at providing breakthrough energy and cost efficiency for large-scale AI deployments.

Just last month, HPE announced that it had delivered the “most powerful supercomputer in the world” – the 100 percent fanless direct liquid-cooled EL Capitan to the U.S. Department of Energy’s Lawrence Livermore Laboratory. The El Capitan system runs 1.742 exaflops with 58.89 gigaflops performance per watt.

“The key there is that you need more than chips,” said Neri of HPE’s supercomputing expertise. “You need a networking fabric that can drive coherence. Then you need the storage, and that data needs to be co-located next to the supercomputer.”

Neri’s comments came after HPE reported better-than-expected results for its fourth fiscal quarter ended October 31 with quarterly AI systems revenue growth of 16 percent to $1.5 billion. The HPE AI systems backlog now stands at more than $3.5 billion with a sales pipeline that is a multiple of that.

HPE sees continued AI momentum with AI model builders, hyperscalers and service providers, said Neri. What’s more, HPE sees “continued momentum” in sovereign AI projects.

As for the enterprise market, Neri said, HPE’s Private Cloud AI– which only became available on September 9 – is already gaining a foothold. “We closed the first deals in Q4 and now we see POCs (Proof of Concepts) and pipeline growing very rapidly,” he said.

Overall, HPE reported “record” quarterly sales of $8.5 billion for its fourth fiscal quarter ended October 31, up 15 percent in constant currency from $7.71 billion. That was well above the Zacks consensus estimate of $8.23 billion. HPE also reported a “record” non-GAAP operating profit of $938 million.

HPE reported non-GAAP earnings per share of 58 cents per share, up 12 percent from the year-ago quarter, and three cents above the Zacks consensus estimate of 55 cents per share.

HPE shares were up 11 percent or $2.36 in mid-day trading to $24.01, a new 52-week high. This after the strong fourth quarter results and a Morgan Stanley upgrade for HPE shares with a target price raise from $23 to $28.

Neri said he is “excited” about the outlook for 2025 given HPE’s $14 billion acquisition of Juniper Networks is set to close early next year.

“We expect the pending acquisition of Juniper Networks to further enhance our portfolio providing customers with complete edge to cloud solutions,” he said. “I am extremely excited about the significant opportunity we have in the coming fiscal year to drive increased value for our shareholders. I am optimistic about what we can achieve and look forward to the year ahead.”

What were the highlights of HPE’s fourth-quarter performance?

We had an exceptional fourth quarter, capping off a super, super strong fiscal year 2024. You can see it in the numbers. Obviously we had record-breaking revenue of $8.5 billion. That’s up 15 percent year over year and nine percent sequentially. That’s a result of the continuous momentum we see in the market because of our innovation.

Second, we delivered again record-breaking performance on operating profit of $938 million and we exceeded our high end of the guidance with non-GAAP diluted earnings per share of 58 cents.

Underneath that, every business segment grew both on an orders and revenue basis sequentially. In many of the segments, we grew orders double-digits year over year. That includes traditional servers, which grew in double-digits for order growth for the third consecutive quarter.

The Intelligent Edge business grew sequentially for the third consecutive quarter. (Intelligent Edge) revenue looks flattish because a lot of the growth comes from subscription based software and services with solutions like SASE, SSE and SD-WAN.

Now we see momentum in the Wi-Fi 7 refresh cycle and also the data center networking business. The only area still going through some digestion is the campus switching. But as you know, as we go through the Wi-Fi 7 refresh, as you refresh the access point you also will have to refresh the switch because you need more power for the access point to power over Ethernet.

What were the key AI metrics in the quarter?

When you look at AI first of all on the revenue side we converted more revenue in the quarter, up 16 percent to $1.5 billion. Today we have a backlog of more than $3.5 billion and a pipeline that’s a multiple of that.

When you look underneath what’s happening with the orders obviously there is a lot of momentum continuing with the model builders and service providers, whether it’s hyperscalers or tier-two and tier-three (service providers). Now we see continued momentum in sovereign AI although sales cycles are longer.

In the enterprise, we have our (HPE) Private Cloud AI which is the perfect offer designed and tailored for the enterprise and our channel. That’s because of the simplicity of the (HPE Private Cloud AI) offer in terms of sales and deployment. We closed the first deals in Q4 and now we see POCs (Proof of Concepts) and pipeline growing very rapidly. Understand we made the offer available on September 9. That is all positive.

How do you feel about the full fiscal year results?

When you look at fiscal year 2024, it was a very strong year. We exceeded $30 billion in revenue. We delivered record-breaking free cash flow of $2.3 billion. We delivered $3.2 billion in operating dollars profit. I can only be pleased with this. As the team and I discussed, the one word that drives all of this is: innovation. As you know, I’ve said always that my role is to bring the best innovation for our customers and our partners so that we can be relevant in the market. That innovation drives growth and growth drives shareholder value.

How did the channel perform during the quarter?

In hybrid cloud, the partner-led business grew nine percent year over year, and now accounts for a quarter of the total indirect revenue and 58 percent of the hybrid cloud business. So more than half of the business in hybrid cloud is driven by the channel.

HPE Alletra now represents 73 percent of the storage revenue which is a 7x increase year over year. Alletra is the fastest-growing product in the history of our company with an annualized run rate of $1 billion.

On the server side, the partner-led revenue grew 16 percent year over year, which accounts for approximately half of the indirect business. Obviously the refresh opportunity is out there with half a million servers up for refresh with our Gen11 servers. Two thirds of our servers are now Gen11.

With our industry-leading HPE Partner Ready Vantage program, we now have 2,000 partners enrolled and we have signed more than $1 billion in as-a-service contracts, growing 40 percent year over year in as a service. Those 2,000 partners are focused on as-a-service with the Partner Ready Vantage program.

All in all, it has been very positive, but we have more work to do. You are as good as the last quarter.

We are excited about 2025.

What is the update on the DOJ (Department of Justice) approval on the HPE acquisition of Juniper?

We are still on track to close the transaction with Juniper in the early part of 2025. Remember on January 10 when we announced the intent to acquire Juniper we said that the transaction will close in the latter part of calendar 2024 or early part of 2025.

We have received unconditional approval from pretty much all the jurisdictions around the globe including the European Union, UK, Australia, South Korea, and many, many others.

The DOJ is going through the process to review. Understand that they are busy with many requests and the transition obviously that’s going to happen. But overall it’s very collaborative and nothing gives me pause that we cannot get this closed for two reasons. Number one because it is pro-competitive because it creates better innovation for customers.

Number two, for the United States, specifically, it is good for U.S. national security because outside the United States we are competing with a bigger number of competitors, including Chinese competitors. So for United States’ national security this is good from a U.S. security standpoint. This is a process. It is still in the original timeline. I’m not concerned, but we have to get through the process.

You were just at HPE Barcelona with Juniper CEO Rami Rahim (pictured). What are you hearing from partners and customers in the field about the potential for the deal and the impact it will have on the networking market?

It was all very positive. In fact, I was very pleased that I had Rami with me to talk about what together we can do for our customers. And it’s not just in networking. It is networking plus the rest of the portfolio. And remember, networking needs to catch up to demands of AI. And the demands from AI are much higher than what we have seen so far from a technology perspective. Networking seems to be lagging that.

HPE is uniquely positioned with our HPE Slingshot which is direct liquid-cooled. Juniper brings its service provider portfolio to the table which drives interconnectivity between data centers and the high-performance fabric you need inside the data center to connect all these GPUs and CPUs in a very efficient way. This is about driving a modern, secure AI driven edge to cloud fabric with a focus on both delivering hybrid cloud and AI, because AI needs hybrid cloud because data lives everywhere.

Customers were all positive. They understand the benefits of it. They like the combination, not just from networking, and that’s why they’re all excited to get this done.

From a partner’s perspective you get access to the Juniper products at scale in many geographies of the world. Now partners can do that through the footprint that Hewlett Packard Enterprise has with our amazing partner ecosystem.

How big an opportunity is HPE VM Essentials for partners given the turmoil in that virtualization market?

It’s huge because customers want choice and flexibility. They don’t want to be locked in into one virtualization layer or stack, and we are offering through HPE VM Essentials two key elements. Number one is the ability to manage multi -stack on premise, including the VMware stack, so you can manage your VMware stack and any other stack you want to deploy. That’s an amazing facility.

The second piece is the ability to offer a separate, alternative virtualization layer, more open source, KVM driven standard that HPE has provided with enterprise grade features, so you can move VMs from one stack to the other stack as they see fit over a period of time. We are also re-architecting some of the applications to containers on bare metal.

My view is that HPE is targeting a specific set of requirements which still manage VMware, an important element of what partners do. But we open up that opportunity for them in a very seamless, operational, efficient way. Once partners move to HPE VM Essentials they can save up to five times the TCO (Total Cost of Ownership).

HPE has been a leader in supercomputing. This week AWS made a big splash with its Ultracluster supercomputer with Trainium chips. What do you think of what AWS is doing in supercomputing versus what HPE has been doing for a long time?

I think building and running supercomputers is a unique expertise. And the reality is that supercomputers are not just about the computing power. It is about the ability to run it in a very efficient way, and then ultimately the colocation of data.

So when you think about supercomputing you need to think about the computing power and the data that comes with it. Every supercomputer we have built around the globe, which, by the way, HPE owns now seven of the top 10 verified systems, including number one, number two and number three. That’s unique expertise. Obviously we have the industry’s first 100 percent fanless direct liquid-cooled architecture.

The key there is that you need more than chips. You need a networking fabric that can drive coherence. Then you need the storage, and that data needs to be co-located next to the supercomputer. If you think about exabytes of data it is hard to say what customers, particularly the most sensitive customers that do a lot of simulation, modeling or very large training models, will do with it. We will see what use cases they can address.

But I don’t see anytime soon the traditional supercomputing workloads moving there because the cost is prohibitive. Now we know hyperscalers, including AWS, tend to focus on disaggregating the architecture so they have more control of their stack. But that’s true for maybe generative AI, but I’m not sure it’s true for the traditional supercomputer workloads.

Source link

lol

Hewlett Packard Enterprise CEO Antonio Neri says he does not see traditional supercomputing workloads moving to AWS’ just-announced UltraCluster AI supercomputer. Hewlett Packard Enterprise CEO Antonio Neri said he does not see traditional supercomputing workloads moving to Amazon Web Services’ just-announced UltraCluster AI supercomputer. “I don’t see anytime soon the traditional supercomputing workloads moving there…

Recent Posts

- Apple Releases Security Updates for Multiple Products | CISA

- The 10 Biggest AWS News Stories Of 2024: CEO Exit, AI And Partners

- CISA Releases Ten Industrial Control Systems Advisories | CISA

- 20 Tech Companies Hiring In The IT Channel: December 2024

- Multiple Vulnerabilities in Apple Products Could Allow for Arbitrary Code Execution