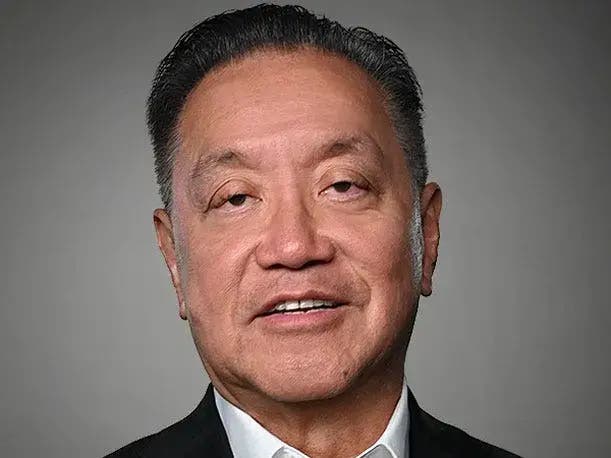

Broadcom CEO Hock Tan: Old VMware Model Created ‘Channel Chaos And Conflict In The Marketplace’

by nlqip

‘You are talking [about] a full range of partners, and whoever made the biggest deals [got] the biggest discount, lowest price, and they [were] out there, basically creating a lot of channel chaos and conflict in the marketplace,’ says Tan.

Broadcom CEO Hock Tan said the “chaos and conflict” that dominated VMware’s go-to-market model prior to Broadcom’s ownership has been simplified thanks to a massive SKU reduction, a cut to the number of channel partners and a move to take thousands of top accounts direct.

“In the past—unlike what we’re trying to do here—everybody was a partner,” said Tan during Broadcom’s earnings call on Wednesday. “I mean, you are talking [about] a full range of partners, and whoever made the biggest deals [got] the biggest discount, lowest price, and they [were] out there basically creating a lot of channel chaos and conflict in the marketplace. Here, the customers can take it directly from VMware through [the] direct sales force, or they can easily move to the resellers to get it that way.”

Tan’s comments come in the wake of the company’s decision to reduce the number of SKUs from 8,000 to four core product offerings and to take the top 2,000 strategic accounts direct.

Tan said that many of VMware’s largest customers prefer buying customized offerings direct from Broadcom.

“The largest 10,000 customers of VMware are large enterprises, the largest banks, the largest health care companies,” he said. “And their view is [they] want very bespoke service, support, engineering [and] solutions from us. So we created a direct approach, supplemented with their VAR of choice when they need to.”

Tan also said during the call that his approach to VMware was different than Broadcom’s previous acquisitions and that the blockbuster deal has given him a new appreciation for channel partners given the large VMware installed base.

“There are 300,000 customers, 300,000,” Tan said. “That’s pretty amazing. … Under CA [which Broadcom acquired in 2018], we took a position of, ‘Let’s pick an A-list of strategic guys and focus on it. I can’t do that in VMware. I have to approach it differently. And we start—and I start—to learn the value of the very strong bunch of partners they have, which are a network of distributors and something like 15,000 VARs, value-added resellers, supported with these distributors. So, we have doubled down and invested in this reseller network in a big way for VMware.”

As of press time, Broadcom did not provide additional comments or details on Tan’s statements or the channel investments the company has made.

The company previously said it invited 18,000 VMware partners to join its Broadcom Advantage Partner Program. While the exact count of VMware reseller partners varied over the years, in 2023 VMware said it had roughly 25,300 reseller partners in its Partner Connect program, indicating approximately 28 percent of previous VMware partners have been cut.

The Impact On Partners

C.R. Howdyshell, CEO of Advizex, a Fulcrum IT Partners Company based in Independence, Ohio, said the VMware go-to-market changes have negatively impacted his business.

“We are off our number from last year,” said Howdyshell. “Just because of the discontent [among customers]. … There isn’t any one of them that I would say is confident that, going forward, this is the best path.”

Howdyshell said his enterprise customers would gladly return to the “chaos” of VMware’s previous go-to-market strategy if it includes better choices of product.

“Customers preferred the options and not being mandated to buy products,” including bundles that contain offerings they aren’t interested in, Howdyshell told CRN.

Howdyshell said those changes have his larger VMware customers deciding to go without vendor support for some VMware products to avoid paying for products they don’t need.

“We have customers that are going without support because of the new SKUs and new pricing,” said Howdyshell. “Large customers are going without support just in principle [due to] being told what they’re expected to buy, and what they can and can’t buy.”

As to Tan’s claims that large customers prefer the new go-to-market model, Howdyshell said he meets regularly with some of those customers. He said, in fact, during a meeting last week with about 30 of his largest customers about AI solutions, those in the room also wanted to know about alternatives to VMware bundles.

“I can’t say whether they’re all on [VMware’s] top 10,000 list, but I’m going to bet most of them would be,” he said. “And what I would say is, in the midst of it, one of the CTOs from a large health care company said, ‘Hey, while we’re talking about how to navigate through the waters of the AI challenges, we should take the same time to try to figure out the VMware bundles.’ Everyone in the room was nodding their head.”

Ensono, a longtime VMware partner based in Downers Grove, Ill., that was named a North America VMWare Cloud Service Provider Pinnacle Partner in the Broadcom Advantage Program, sees value in the VMware changes Broadcom has made.

Senior Vice President and Managing Director of North America Paola Doebel said employees on the ground found that the previous program was difficult to manage, and Broadcom has offered their organization more direction.

“Prior to their current partner program, VMware’s collaboration with CSPs/MSPs like Ensono was challenging for the field teams for a variety of reasons,” Doebel wrote in an email to CRN on Thursday. “Their current program does provide better clarity for CSP/MSP partners and the support and collaboration we can expect from VMware and their field.”

Broadcom’s VMware Changes Have Created Disruption

Broadcom’s significant changes to VMware since closing the $69 billion deal have created disruption for both customers and partners, solution providers have told CRN. It cut the company into four new divisions, terminated partners from the previous program, eliminated perpetual licenses for popular items like VMware’s hypervisor and bundled those with “shelfware,” then changed the pricing model which increased the cost of renewals by as much as 10x for some customers.

In January, Broadcom barred VMware partners from registering any deals with “strategic accounts,” instead taking those customers direct. Then it sent out invitations to select partners to join its new program.

Ahead of the VMware acquisition, Broadcom had vowed not to raise VMware prices, but many customers’ bills have risen in the time since, Forrester principal analyst Tracy Woo has previously told CRN, with customers seeing 3x to 8x to 10x price increases. She said the new VMware per core pricing “is another way of masking that you are also responsible for paying for a lot of shelfware, given their product SKU simplification.”

Contrary to Tan’s assertions that the VMware acquisition is being handled differently, Woo told CRN on Thursday that from what she has seen, Broadcom has not deviated from how it handled the CA Technologies purchase or its 2019 acquisition of Symantec for Enterprise: taking big customers direct.

“This is the same play here with VMware, except the number expanded from 600 to [the] top 2,000 clients,” she said. “The top clients have always been supported directly by Broadcom and the next layer by its channel partners. Sure, there’s been a reduction or trimming of VMware’s vast channel of partners, but the same play is still in effect. I wouldn’t take anything Hock said to be different from what has been Broadcom’s playbook in the past.”

Tan said VMware’s revenue in the second quarter, ending May 5, was $2.7 billion. That is up from $2.1 billion last quarter, but down $580 million if comparing VMware’s results from a similar time frame a year ago, when VMware’s first quarter revenue was $3.28 billion.

Tan said VMware revenue is on track to reach a $4 billion per quarter run rate this year, while Broadcom’s cost to operate the company is getting smaller. Broadcom has shrunk the VMware workforce by thousands of employees since taking over, and Tan expects to reduce the quarterly cost to operate VMware from about $2.3 billion pre-acquisition to $1.2 billion soon.

Broadcom said its revenue of $12.48 billion was up 43 percent from last year. Broadcom’s net income came in at $2.12 billion, or $4.42 per share. The stock is up 187 percent since May 2022 when Broadcom unveiled its plan to buy VMware.

Source link

lol

‘You are talking [about] a full range of partners, and whoever made the biggest deals [got] the biggest discount, lowest price, and they [were] out there, basically creating a lot of channel chaos and conflict in the marketplace,’ says Tan. Broadcom CEO Hock Tan said the “chaos and conflict” that dominated VMware’s go-to-market model prior…

Recent Posts

- Arm To Seek Retrial In Qualcomm Case After Mixed Verdict

- Jury Sides With Qualcomm Over Arm In Case Related To Snapdragon X PC Chips

- Equinix Makes Dell AI Factory With Nvidia Available Through Partners

- AMD’s EPYC CPU Boss Seeks To Push Into SMB, Midmarket With Partners

- Fortinet Releases Security Updates for FortiManager | CISA